Commitments and Ambitions

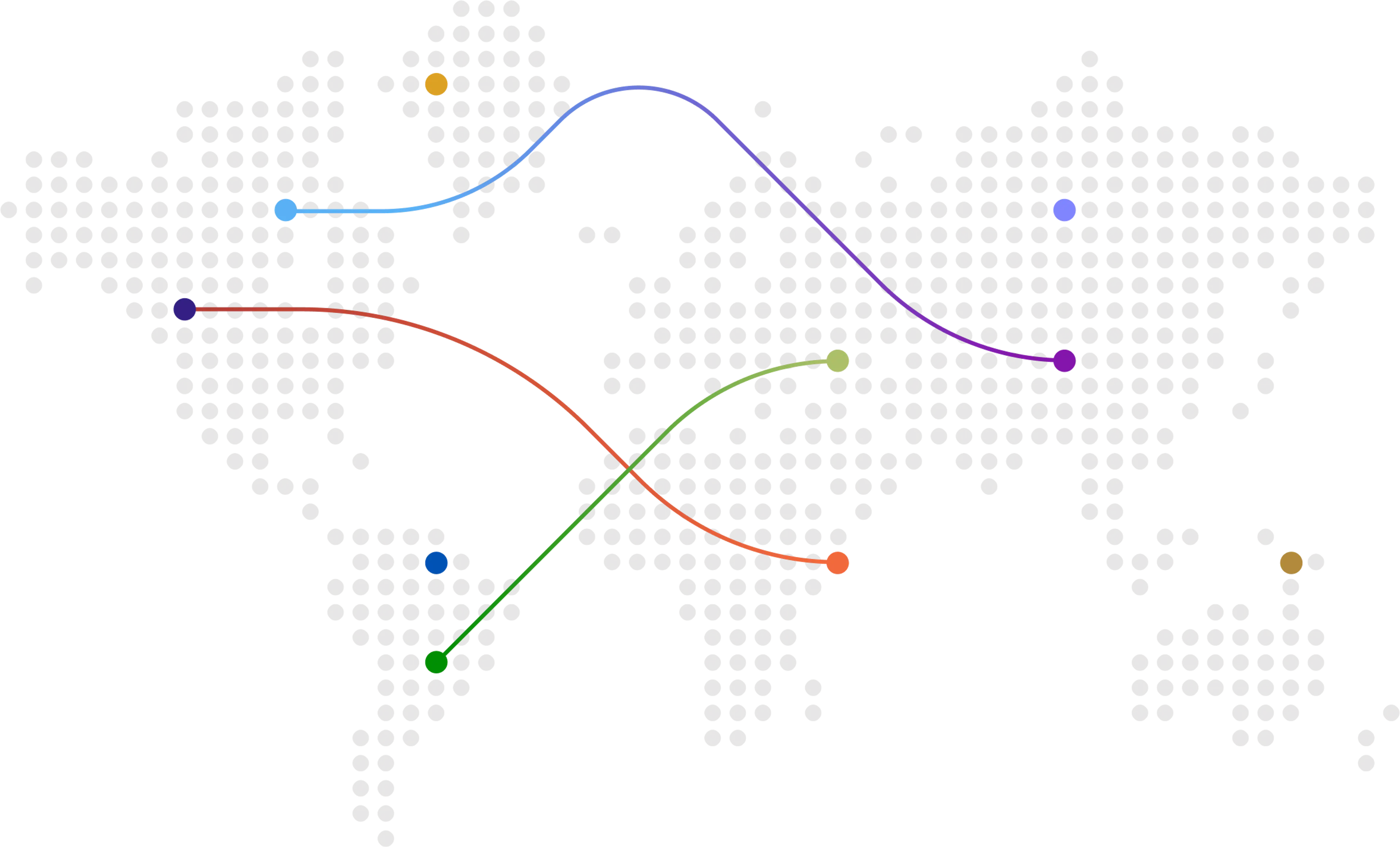

To align financial reforms with climate goals, Brazil must show commitment by strengthening and delivering on its Nationally Determined Contribution (NDC) while also embracing ambition through the integration of climate risk, transparency, and forward-looking investment in its financial system.

Explore Theme